Country Specific Tax Information

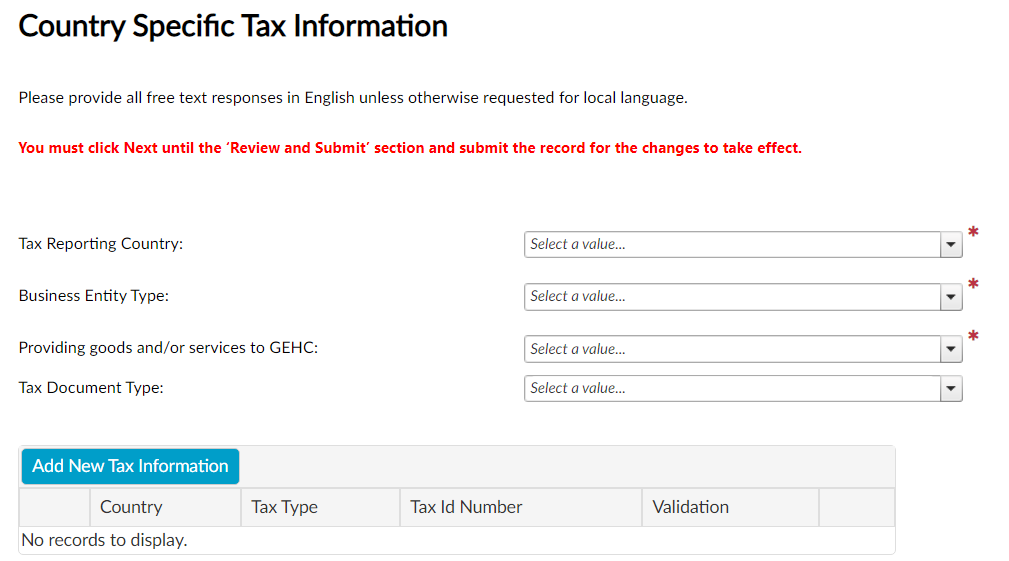

The Country Specific Tax Information section includes details to add tax information and is unique to each supplier’s location. SOAR populates the required tax information based on the country selected.

Country Specific Tax Information Instructions

Select the Country Specific Tax Information in the following dropdowns:

Tax Reporting Country

Business Entity Type

Providing good and/or services to GEHC

Tax Document Type

Click Add New Tax Information to add another Tax Reporting Country record.

Click Edit to change the Tax Reporting Country, Tax Type or Tax ID Number.

Click Delete to remove Tax Information.

In the USA a valid TIN tax type is required. If the TIN number is invalid in the validation column, you may click Next>> to continue. However, a Letter for TIN Validation IRS Form 147C must be uploaded before submitting registration.

The Supplier Legal Name in the General Business Section must match the Tax ID Number for select Supplier Countries to validate tax information.

Complete the Tax Reporting Country first to populate the subsequent Country Specific Tax Information fields and tax document(s).

The Tax Classification dropdown is applicable to the United States LLC Business Entity Type.